Page 9 - 2023 Moreno Valley Popular Annual Financial Report

P. 9

PROPERTY T AX & PROPERTY TAX REVENUES

S A L E S TA X

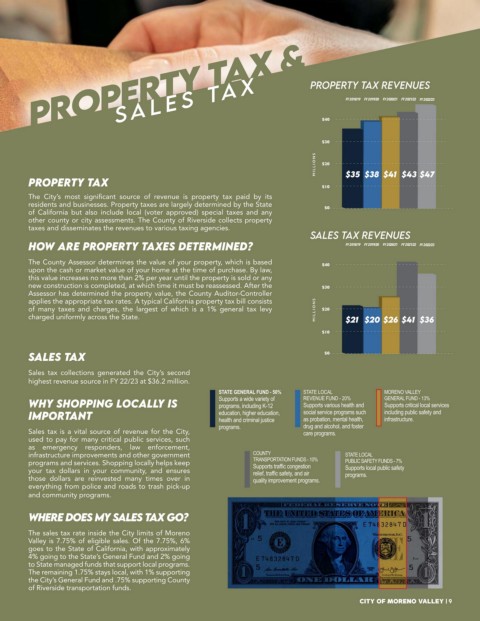

FY 2019/20 FY 2020/21 FY 2021/22 FY 2022/23

FY 2018/19

$40

$30

MILLIONS $20

PROPERTY TAX $10 $35 $38 $41 $43 $47

The City’s most significant source of revenue is property tax paid by its

residents and businesses. Property taxes are largely determined by the State $0

of California but also include local (voter approved) special taxes and any

other county or city assessments. The County of Riverside collects property

taxes and disseminates the revenues to various taxing agencies.

SALES TAX REVENUES

HOW ARE PROPERTY TAXES DETERMINED? FY 2018/19 FY 2019/20 FY 2020/21 FY 2021/22 FY 2022/23

The County Assessor determines the value of your property, which is based $40

upon the cash or market value of your home at the time of purchase. By law,

this value increases no more than 2% per year until the property is sold or any

new construction is completed, at which time it must be reassessed. After the $30

Assessor has determined the property value, the County Auditor-Controller

applies the appropriate tax rates. A typical California property tax bill consists

of many taxes and charges, the largest of which is a 1% general tax levy MILLIONS $20

charged uniformly across the State. $21 $20 $26 $41 $36

$10

SALES TAX $0

Sales tax collections generated the City’s second

highest revenue source in FY 22/23 at $36.2 million.

STATE GENERAL FUND - 50% STATE LOCAL MORENO VALLEY

WHY SHOPPiNG LOCALLY IS Supports a wide variety of REVENUE FUND - 20% GENERAL FUND - 13%

Supports various health and

Supports critical local services

programs, including K-12

IMPORTANT education, higher education, social service programs such including public safety and

infrastructure.

as probation, mental health,

health and criminal justice

programs. drug and alcohol, and foster

Sales tax is a vital source of revenue for the City, care programs.

used to pay for many critical public services, such

as emergency responders, law enforcement,

infrastructure improvements and other government COUNTY STATE LOCAL

TRANSPORTATION FUNDS - 10%

programs and services. Shopping locally helps keep Supports traffic congestion PUBLIC SAFETY FUNDS - 7%

Supports local public safety

your tax dollars in your community, and ensures relief, traffic safety, and air programs.

those dollars are reinvested many times over in quality improvement programs.

everything from police and roads to trash pick-up

and community programs.

WHERE DOES MY SALES TAX GO?

The sales tax rate inside the City limits of Moreno

Valley is 7.75% of eligible sales. Of the 7.75%, 6%

goes to the State of California, with approximately

4% going to the State’s General Fund and 2% going

to State managed funds that support local programs.

The remaining 1.75% stays local, with 1% supporting

the City’s General Fund and .75% supporting County

of Riverside transportation funds.

City of Moreno Valley | 9